Breaking The Stigma on Men’s Cancers

November 19, 2025

Southeast Asia’s Breast Cancer Gap Explained

February 20, 2026Learn how Malaysia’s new Social Exchange Program could reshape giving, investing, and the role of your Ringgit in building a fairer future.

Intro

Earlier this year, the Malaysian Securities Commission announced its pilot program for the country’s first Social Exchange Program. With the program set to kick off in 2026, we’ll dissect what a social exchange program is, how it works, who benefits from it, and why it could change the way your Ringgit makes a difference.

What is a Social Exchange Program?

A social exchange is exactly what it sounds like — a marketplace where non-profits and social enterprises can raise funds from investors, not just donors.

It creates a symbiotic relationship:

- Non-profits gain access to new funding avenues beyond traditional philanthropy.

- Investors receive both financial and social returns.

- And society benefits from the positive outcomes these projects deliver.

At the heart of this concept is the impact investor, an individual or institution that looks beyond sole profit. They invest in initiatives that generate measurable social outcomes alongside financial gain. These returns could take the form of improved living standards, wider access to healthcare, cleaner energy, or affordable housing.

Impact investment has already proven successful around the world. From microfinancing programs in Bangladesh, to affordable housing developments in Kenya, to renewable energy initiatives in Europe. Malaysia’s social exchange aims to channel that same spirit locally, using our capital market as a platform for collective progress.

What are the benefits?

For Charities

One of the biggest reasons this development matters is that, unlike traditional philanthropy, a social exchange functions as a marketplace — a space the third sector has historically struggled to access. Fundraising for NGOs often happens through street outreach, events, or grant applications, all of which rely on slower, relationship-driven processes that appeal to empathy but don’t necessarily lend themselves to scale.

Non-profits, by nature, are purpose-driven and problem-focused. They prioritise the cause above all else, often at the expense of growth. As Dan Pallotta pointed out in his TED Talk, charities are too often rewarded for how little they spend, rather than how much they achieve.

Funding has long been the greatest challenge. How much a charity can accomplish depends directly on how much support it can secure, and raising those funds, whether through corporate sponsorships or public donations, is often a long, trust-dependent process.

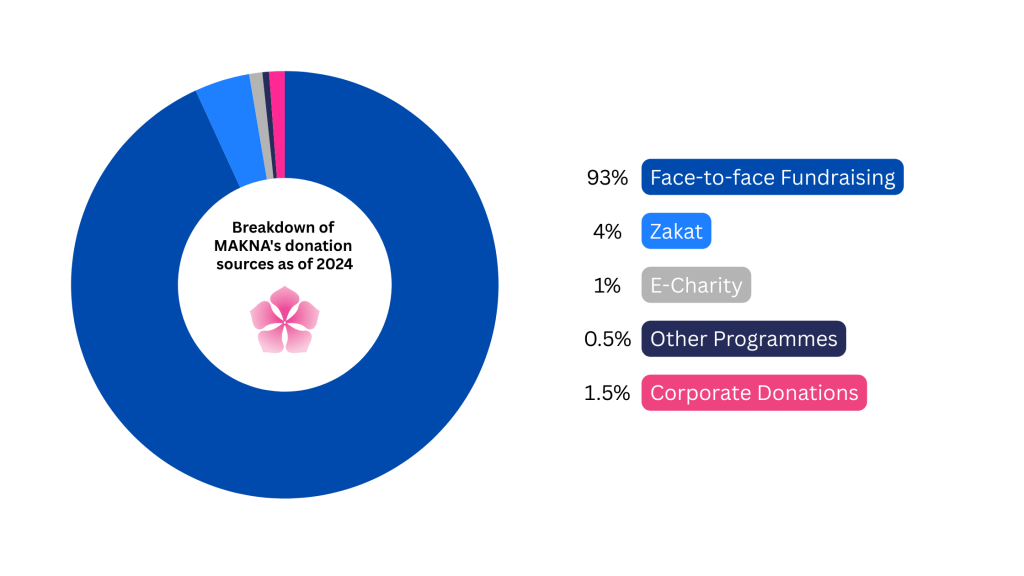

MAKNA itself faces the same challenge. Out of the RM42 million (USD 10 million) we raise annually, only 1.5% comes from corporate donations. The majority — roughly 93% — comes from individual donors. That imbalance highlights just how limited the corporate giving pipeline can be, and how much potential for exponential growth exists if charities gain access to a structured investment platform.

A social exchange could change that. By connecting NGOs directly with impact investors, it creates an avenue for large-scale, measurable funding. Instead of relying solely on goodwill, organisations can now participate in a results-based ecosystem where transparency, accountability, and impact determine value.

Many of Malaysia’s most persistent challenges, such as unequal access to healthcare in rural districts, gaps in education quality, and rising living costs in vulnerable communities, can’t be resolved through annual donations alone.

They require long-term, scalable financing models that allow organisations to plan beyond one budget cycle at a time. A social exchange creates exactly that possibility: the chance to tackle systemic problems with systemic solutions.

It’s an opportunity for charities to rethink sustainability, plan for scale, and take on bigger projects & initiatives that can help tackle systemic problems at their roots rather than just firefighting.

For Investors

Investors are a straightforward cohort — profit-driven, bottom-line focused, and performance-oriented. It’s that very mindset that has helped build a RM4.2 trillion (USD 997 billion) Malaysian capital market.

But over time, many have realized that profit and purpose are not mutually exclusive. Since the emergence of corporate social responsibility in the mid-20th century, and especially in today’s interconnected world, companies are increasingly rewarded for investing not only in themselves but in the well-being of the communities around them.

The Social Exchange introduces a new frontier for this evolution. By giving investors direct access to projects initiated by the third sector, it allows them to support causes that align with their goals while maintaining visibility and confidence in how their capital is used.

It’s a platform that removes the barriers of discovery. Instead of requiring exhaustive research to identify mission-aligned partners, investors can now find and fund credible NGOs and projects that meet verified standards of impact and transparency.

Simply put, through a social exchange, intent becomes impact.

For You & Your Ringgit

So, what does this all mean for you?

Well, the money market isn’t some distant, abstract machine; it’s built on the savings and earnings of ordinary people. Anyone with an income contributes to it, whether knowingly or not. The money you deposit in banks doesn’t just sit idle; it’s reinvested into ventures that those institutions believe will bring value to them, to their stakeholders, and, indirectly, to the wider economy. That’s the essence of shared dividends.

Now, can you invest directly into a charity project of your choosing? Not quite. Social exchange investments typically operate at an institutional level. For individuals who want a more personal connection, direct donations remain the most meaningful route, ensuring that 100% of your contribution goes to the cause and that you’re part of their journey through regular updates and community engagement.

On a broader scale, the benefits do ripple outward. A stronger, more transparent connection between capital markets and the third sector strengthens both economic and social resilience. It helps demystify where money flows and, more importantly, ensures that more of it flows toward projects with tangible human impact.

When charities are empowered to scale through better funding, the outcome is that more work gets done. And when that happens, your Ringgit doesn’t just grow in value, it grows in purpose.

From Firefighting to Foresight

For many charities, unstable and unpredictable funding keeps them in a constant state of firefighting. When limited resources aren’t necessarily guaranteed, organisations are forced to prioritise immediate needs over long-term solutions. Prevention, innovation, and systemic change become secondary to survival.

Organisations like Médecins Sans Frontières (MSF) have long acknowledged the limits of emergency response without sustained, system-level investment. While MSF is known for stepping in during crises, it has repeatedly highlighted that prevention, healthcare infrastructure, and long-term capacity building remain chronically underfunded. The result is a cycle where organisations respond heroically, but rarely have the resources to prevent the next crisis from occurring.

This challenge is increasingly recognised within the sector itself. In a recent piece on strategic foresight for charities, digital agency Torchbox notes that many non-profits are so consumed by day-to-day delivery that they lack the space, funding, and certainty needed to plan ahead.

What’s in the future?

Social exchange platforms aren’t new, nor is impact investing, but they are gaining momentum, especially in developing nations, where the effective deployment of resources can make or break progress.

For LMICs like Malaysia, where infrastructure and development remain concentrated in major cities, these platforms can bridge the socio-economic gaps that government initiatives alone cannot fill. The third sector has always played a crucial role in reaching the communities that fall between those cracks.

In the long run, initiatives like the Social Exchange Pilot Program could redefine how Malaysia approaches social welfare — moving from charity as an act of goodwill to impact as an act of design.

Empowering purpose-driven organisations with the same financial tools as corporations transforms scale into sustainability, and intent into lasting impact.

For MAKNA and other NGOs, this marks a step toward sustainability — a chance to ensure that every Ringgit raised can go further, do more, and last longer. For investors, it’s a new kind of participation: one that measures return not just in numbers, but in meaningful outcomes.

The success of the social exchange will depend on how we, as a society, respond to it. Whether you’re a policymaker, investor, or everyday Malaysian, this is an opportunity to rethink the value of giving, and about the underlying systems that drive it.

If you’d like to explore how initiatives like this shape the future of social welfare in Malaysia, or how MAKNA continues supporting vulnerable communities through evolving funding landscapes, we invite you to learn more about our work — and the impact your Ringgit can make.